💸 Morgan O'hana's Defacto Brings Instant, Flexible Financing to SMBs with a 10M€ Series A Top-Up

FemWealth Startups

Morgan O'hana’s Defacto Brings Instant, Flexible Financing to SMBs with a €10M Series A top-up

Small and medium businesses (SMBs) are a key driver of economic growth and employment across Europe. However, they are underserved by traditional lenders. Furthermore, they are highly impacted by the current economic and financial instability making access to working capital even more difficult.

Co-founded by Morgan O’hana, Jordane Giuly, and Marc-Henri Gires, Paris-based Defacto is on a mission to provide instant, flexible financing to SMBs in Europe. Its API-first product enables third parties such as B2B marketplaces, fintechs, and other digital platforms (including Malt, Qonto, Pennylane, and Libeo) to embed the financing solution directly in their products. SMBs can benefit from a seamless and instant lending experience, while platforms increase their differentiation and customer satisfaction.

Since its founding in 2021, Defacto has deployed over €300 million in small business financing with an average quote-to-capital time of less than 27 seconds. The company now aims to deliver a personalised lending experience that offers proactive recommendations to SMBs on the optimal times to take on debt, facilitating faster business growth and sustainable practices.

Strong Female Leadership

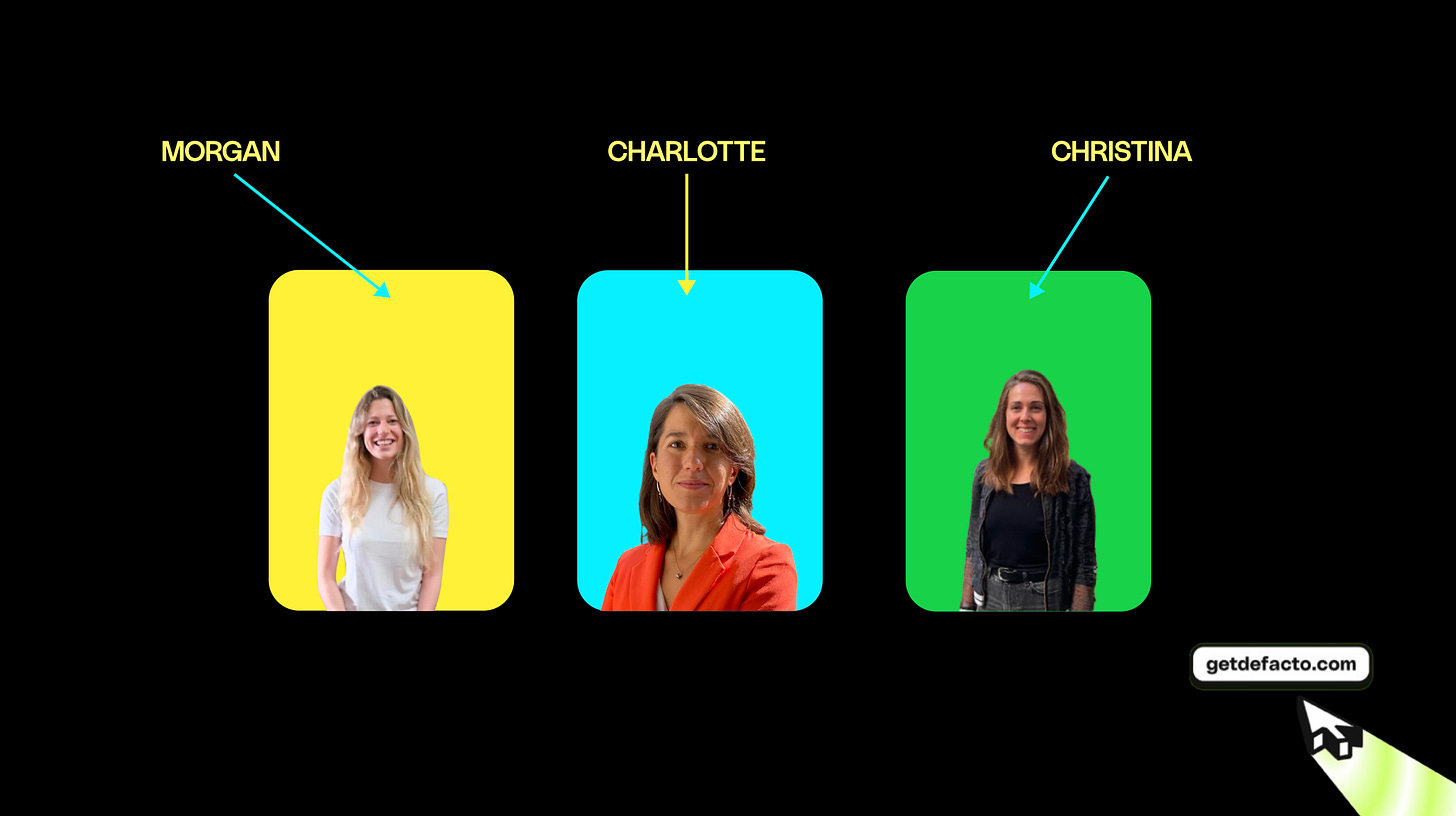

Defacto’s dynamic team of highly skilled and experienced female business executives sets it apart from many European fast-growing companies. With a focus on sustainable growth, their leadership is defined by pragmatism, humility, and other qualities essential to startup success: resilience, adaptability, collaborative spirit, and intuitive decision-making.

Co-founder Morgan O’Hana combines her Moroccan and South African roots with the sharp business acumen she honed at BCG in the private equity realm and in a foundational role at Spendesk where she fostered partnerships. In her current role, she channels this expertise into a partnership-driven commercial strategy to elevate the company's position in the European embedded lending market.

Charlotte Gounot - a graduate of the prestigious French engineering Ecole Polytechnique and an experienced civil servant, and adviser of the Minister on economic recovery and ecological transition - is in charge of funding, prudential, and compliance. She secured a groundbreaking €167 million securitization deal with Citi Bank in record time, making Defacto the youngest firm to achieve such a feat.

Christina Bassinet-Cooper, previously at ManoMano, leads customer experience. Since joining Defacto in 2022, she has redefined the customer and partner experience, scaling the operation from 70 to over 5,000 customers through her ethos of automation, proactiveness, and unwavering customer focus.

New Funding

A few months after closing a debt line, solidified by a €167M securitization fund, the company has raised an additional €10 million in a Series A extension round from new investor Citi Ventures and existing investors Northzone, Headline, and Global Founders Capital.

On the new funding round, o-founder Morgan O’hana comments:

“We are sincerely thrilled and humbled to have Citi Ventures join our adventure. The additional funding will support Defacto in fulfilling our mission of providing instant, fair, and convenient access to SMEs in Europe. This journey has been filled with excitement and challenges, and we can’t wait for what’ next.”

Jelena Zec, Director of Venture Investing at Citi Ventures adds:

“As Citi Ventures works to expand our investment activity in Europe — particularly in the region’s emerging embedded finance ecosystem — we’re delighted to make Defacto our first France-based portfolio company.”

With the new funding and a refreshed brand, the company plans to transform its instant lending platform into a personalised lending experience, to improve and empower small and medium-sized businesses (SMBs) to strategically utilize debt to accelerate their growth. Aligned with its ambition of becoming a European leader in B2B lending by 2025, Defacto is poised to expand its presence in the European market, particularly in Germany.

For more information about Defacto visit getdefacto.com.