Happy New Year, FemWealth Friends,

Welcome to this year’s first edition covering the highlights of 2023, investors’ predictions for 2024, women-led startup funding news and VC fund launches, women’s health, and more.

2023: The biggest stories in FemWealth

2023: The biggest stories in FemWealth In 2023, FemWealth covered 800+ women-led startup funding rounds (from family & friends investments to Series E) and 100+ VC fund launches across the globe. Here are some of the biggest stories of 2023: Led by Fidji Simo

FemWealth Favourites ❤️

Startups: Nabla raises another $24 million for its AI assistant for doctors that automatically writes clinical notes - Co-founded by Delphine Groll (COO), Paris-based startup Nabla raised a $24 million Series B funding round led by Cathay Innovation, with participation from ZEBOX Ventures.

knownwell Raises $20M Series A From A16Z to Scale the First Patient-Centered Healthcare Home For Those With Overweight and Obesity - Co-founded by Brooke Boyarsky Pratt and Dr. Angela Fitch, Boston-based knownwell is an in-person and virtual, weight-inclusive primary care and metabolic health company. It announced a $20 million Series A round led by Andreessen Horowitz, with existing investor Flare Capital Partners also participating.

Medallion, a platform for artists to connect directly with fans, raises $13.7M - Co-founded by Josephine Yu (CPO) and Jesse Bellin (VP of Operations), the platform offers artists a dedicated digital hub for promoting album releases, tour dates and merch drops, selling digital collectibles, and sharing exclusive content to foster deeper connections with fans. The US-based company closed $13.7 million in Series A funding, co-led by Dragonfly and Lightspeed Faction. Coinbase Ventures, Infinite Capital, J17, The Chernin Group, Third Prime, Zeal Capital, Bill Silva Entertainment, Black Squirrel, Foundations Artist Management, Method, and TAG Music also participated in the round.

HURR raises a total of £7.9m to fuel growth of its rental platform - Co-founded and led by Victoria Prew, the London-based peer-to-peer clothing rental marketplace, secured a $12.7 million round. Praetura Ventures led, joined by Octopus Ventures, Ascension, and D4 Ventures.

Okomera raises 10.2 million euros to predict responses to cancer treatments (in French) - Co-founded by Sandra Jernström (CSO), Paris-based Okomera is developing a device for analyzing the effectiveness of anti-cancer treatments. It raised €10.2 million in Seed funding. Résonance led the round, with participation from Polytechnique Ventures and Berkeley Skydeck Fund.

HYDROGRID makes waves with $8.5M Series A for optimised, automated hydropower - Led by Janice Goodenough, HYDROGRID offers automated IoT software for real-time planning and dispatch of hydropower plants. The Austrian company secured $8.5 million in Series A funding. Inven Capital and Karma Ventures led the round, joined by CNB Capital and SET Ventures.

London-based Fiat Republic raises €6.4 in seed extension to bridge the gap between web3 and traditional banks - Co-founded by Martyna Lewinska (CTO), Amsterdam-based Fiat Republic connects cryptocurrency platforms with traditional banks. It secured $7 million in extended Seed funding. Kraken Ventures, Fabric Ventures, Arca, Inovo.vc, Speedinvest, Credo Ventures, and Seedcamp participated in the round.

Vectoflow secures €4M Series A for its customised flow measurement tech - Co-founded and co-led by Katharina Kreitz, Vectoflow produces 3D printed flow measurement systems. Bayern Kapital Innovations fonds II, WN Invest, asto One Investment, argo vantage, Schwarz Holding, Dr Rolf Pfeiffer, AM Ventures, and KfW Bankengruppe participated in the company’s €4 million Series A.

Biorithm Secures $3.5M in Series A Funding for Its Obstetric Remote Monitoring Solution - Co-founded by Pina Marziliano, Singapore and US-based Biorithm provides a clinical-grade fetal monitor and a mobile application that enables healthcare professionals to monitor expectant mothers. It raised a $3.5 million Series A round co-led by Adaptive Capital Partners, and Seeds Capital.

Y Combinator-backed Intrinsic is building infrastructure for trust and safety teams - Co-founded and led by Karine Mellata, Intrinsic aims to give safety teams the tools necessary to prevent abusive behavior on their products. It raised a $3.1 million Seed round from Urban Innovation Fund, Y Combinator, 645 Ventures, and Okta.

UltiHash raises $2.5M Pre-Seed funding for sustainable data storage - Co-founded by Katja Belova, UltiHash brings byte-level deduplication independent of data types to every data infrastructure. The Berlin-based company raised $2.5 million in Pre-Seed funding from investors including Inventure, PreSeed Ventures, and Tiny Supercomputer Investment Company.

Manina Medtech raises €1.75M for IVF efficacy - Co-founded by Monica Rodriguez de la Vega, Manina Medtech provides a device that increases the chances of success for embryo transfer. The Barcelona-based startup raised €1.75 million in a round led by Medex Partners with additional support from business angels and the Ministerio de Ciencia e Innovación.

Two ex-Wall Streeters want to solve one of VC’s biggest problems: Warm introductions - Co-founded by Stephanie Rieben, Diadem Capital raised $600,000 Pre-Seed funding to build a company, investor, and lending matching program. Launch NY, a US-based fundraising platform led the round.

GIN E-Bikes secures £510,000 investment for expansion and new models - Co-founded by Ukrainian entrepreneur Marina Vlasenko, GIN E-Bikes produces hybrid bikes designed for long-distance journeys. Ukrainian investment company Toloka.vc, a syndicate of private investors provided the funding.

OASYS NOW is on a mission to connect patients with rare and debilitating health conditions to clinical trials - Co-founded by Sara Okhuijsen (CTO), OASYS NOW’s platform streamlines the trial matching process, aiming to enhance patient engagement and accelerate medical research while maintaining data privacy. The Netherlands-based company announced a €285,000 Pre-Seed investment round.

VC: Springdale Ventures Closes $40M Fund II to Invest in Transformative Early-Stage Consumer Brands - Co-founded by General Partner Genevieve Gilbreath, US-based Springdale Ventures launched its second fund with $40 million in capital commitments to invest in early-stage consumer brands across the food, beverage, pet, health, and beauty sectors.

Gale Wilkinson, a managing partner at the early-stage fund Vitalize. Her firm just closed a $23.4 million Fund II after two years of fundraising - Features Gale Wilkinson, Managing Partner at VITALIZE

Former Anthemis partner soft-launches new fintech-focused venture firm - Ruth Foxe Blader, an ex-Anthemis partner and co-founder of WVC:E, launched Foxe Capital, a New York City VC firm that aims to back FinTech companies globally.

Players Fund adds top female athletes to its Venture Capital firm - Players Fund, the UK’s first athlete-led venture capital firm welcomed Dame Jessica Ennis-Hill, Eni Aluko, Allyson Felix, Nikita Parris, and Danielle Carter as new partners. The firm is on a mission to enable athletes to make an impact on and off the field and open up venture capital to broader audiences.

Meet 13 of Europe’s newest female partners - Sifted listed 13 female VCs who were promoted or hired as partners, or who founded their funds in 2023 | Also read How do I get a job in VC? by Sequoia’s VP of Talent Zoe Hewitt

“What most excites me is that today’s cast of successful women entrepreneurs is not limited to consumer products and dating apps. We’re seeing breakout companies, public and private, being led by women across edge tech, enterprise SaaS, fintech, health tech, therapeutics, and much more. I’m thinking of Gwynne Shotwell (SpaceX), Melanie Perkins (Canva), Julia Hartz (Eventbrite), Jennifer Doudna (Crispr), Adi Tatarko (Houzz), Christina Cacioppo (Vanta), Cristina Junqueira (Nubank), Daphne Koller (Coursera), just to name a few. At a time when it’s all the more important for today’s creative tech entrepreneurs to make tough, thoughtful decisions, I think we’ll see even more women rising to the occasion. Call me biased, but I think this is a very good thing.” - Rebecca Lynn, co-founder of Canvas Ventures

14 Predictions For Venture Capital In 2024 by Maren Thomas Bannon, co-founder and Partner at January Ventures

11 VC predictions for 2024 - Includes predictions from Sophia Bendz, partner at Cherry Ventures, Jeannette zu Fürstenberg, Founding Partner of La Famiglia, and more.

“I expect more of a focus [this] year industry-wide on putting capital into the hands of women. …[2024] will see the launch of a higher number of new women-led VC funds and funds with partners from much more diverse backgrounds. For those unable to raise a full fund, women investors will carve out niche coverage areas overlooked by traditional VCs. Capital will keep flowing into promising spaces that mainline firms are not prioritising, such as deep tech. While VC culture remains challenging for women, those who have exited big funds will find opportunities by banding together and identifying emerging pockets of opportunity.” - Ekaterina Almasque, General Partner at OpenOcean

Women’s health is gaining traction — and a top VC predicts a blockbuster IPO for Maven could pave the way for more transactions - Featuring Chrissy Farr, a principal at OMERS Ventures

Women’s Health: Startups and physicians must unite to empower women’s health

“Historically, investigation of women’s health concerns is prioritized by level of lethality (cancer) and propagation of the species (fertility) — two of the most developed and funded areas of women’s health. However, we’re out of luck regarding anything related to quality of life, everyday issues women everywhere face.” - Lyndsey Harper, a board certified OB-GYN, a fellow of the International Society for the Study of Women’s Sexual Health, and founder and CEO of women’s health startup Rosy

Women’s Wealth & Leadership: 80% Of Forbes’ 100 Most Powerful Women Are 50+ (Of Course) - On Forbes’s latest 100 Most Powerful Women List, 80% of nominees are over age 50 and half are over 60.

What I’m Reflecting On 💭

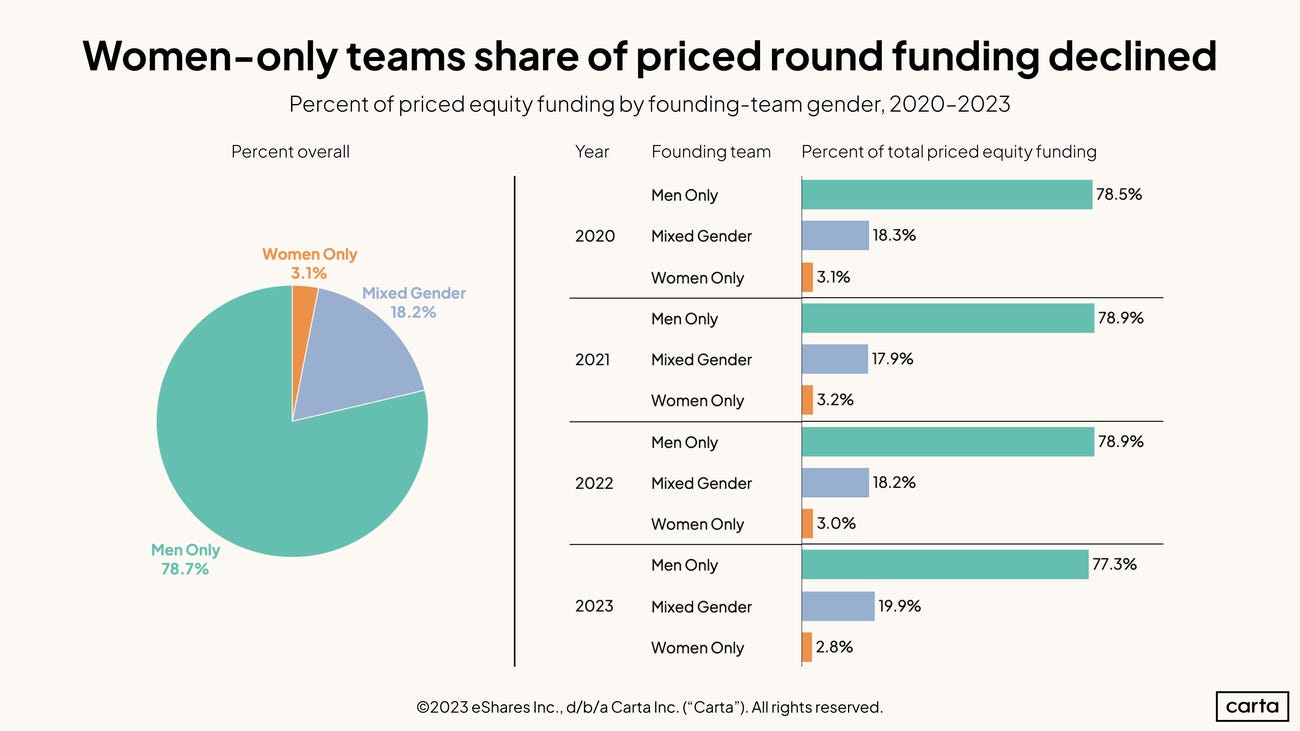

Venture capital’s steep decline is leaving female startup founders in the cold, new data shows (Business Insider $) - According to a recent Carta report, women-only teams raised 2.8% of all venture funding in 2023, the lowest percentage in four years.

Thank you for reading FemWealth! What type of stories would you love to read in 2024? Share your thoughts at femwealth@substack.com.

Have an excellent start to the year! ✨

Anamaria

Founder & Writer of FemWealth